CCC 2022 Progress Report

The CCC 2022 progress report urges the UK parliament to build on the success of the UN COP26 summit in Glasgow last November, closing important policy gaps to enable delivery of the Net Zero ambitions

The CCC 2022 progress report urges the UK parliament to build on the success of the UN COP26 summit in Glasgow last November, closing important policy gaps to enable delivery of the Net Zero ambitions

The CCC 2022 progress report urges the UK parliament to build on the success of the UN COP26 summit in Glasgow last November, closing important policy gaps to enable delivery of the Net Zero ambitions

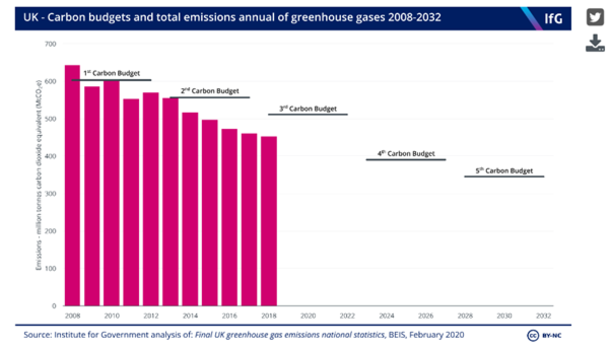

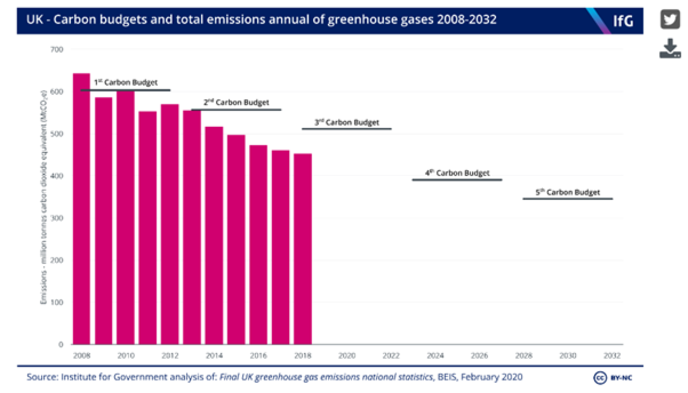

The UK greenhouse gas emissions were 447 MtCO2e in 2021, which is 47% below the1990 levels and on track to achieving the 4th carbon budget target (Figure 1).

The CCC report highlights encouraging developments in the EV car and renewable energy sectors, both which are supported by robust policy frameworks. On the other hand, major policy gaps are identified in relation to industrial resource efficiency and electrification, engineered GGR options, and decarbonisation of smaller operations that are outside the UK ETS. Therefore, better risk management and contingency planning will be vital to ensure the ambitions are achieved on time. More demand-side measures and efficiency improvements are also recommended. Furthermore, the report advocates the costs and benefits of the low-carbon transition to be distributed fairly, while also guaranteeing energy affordability.

Key near-term policy recommendations linked with industrial decarbonisation are summarised below:

Bioenergy:

Engineered Removals:

Hydrogen:

Electricity

Manufacturing:

Fossil fuel supply

https://www.theccc.org.uk/wp-content/uploads/2022/06/Progress-in-reducing-emissions-2022-Report-to-Parliament.pdf